ACFE CFE-Financial-Transactions-and-Fraud-Schemes - Study Material - Certified Fraud Examiner - Financial Transactions and Fraud Schemes Exam

🎉 Limited Time Mega Sale! (40–70% OFF)

Don’t miss out — offer ends in 2h 0m 0s

CFE-Financial-Transactions-and-Fraud-Schemes Study4Pass Exam Detail

Get ready to conquer the ACFE CFE-Financial-Transactions-and-Fraud-Schemes – Certified Fraud Examiner - Financial Transactions and Fraud Schemes Exam certification with Study4Pass. Our platform combines realistic exam simulations, up-to-date content, and an intuitive interface to guide you every step of the way and boost your confidence on exam day.

Question & Answers

Exam Popularity

Free Updates

Latest updated date

Average Score In Real Exam

Questions (word to word)

What is in the Premium File?

Single Choices

179 Questions

Fill in Blanks

7 Questions

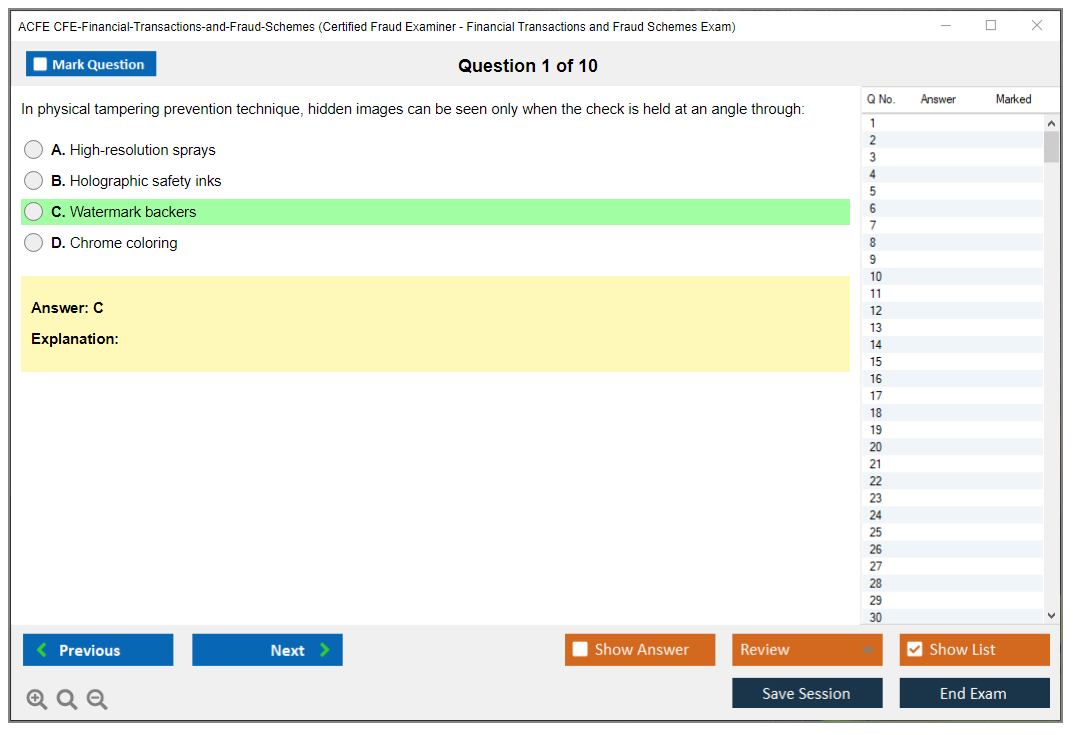

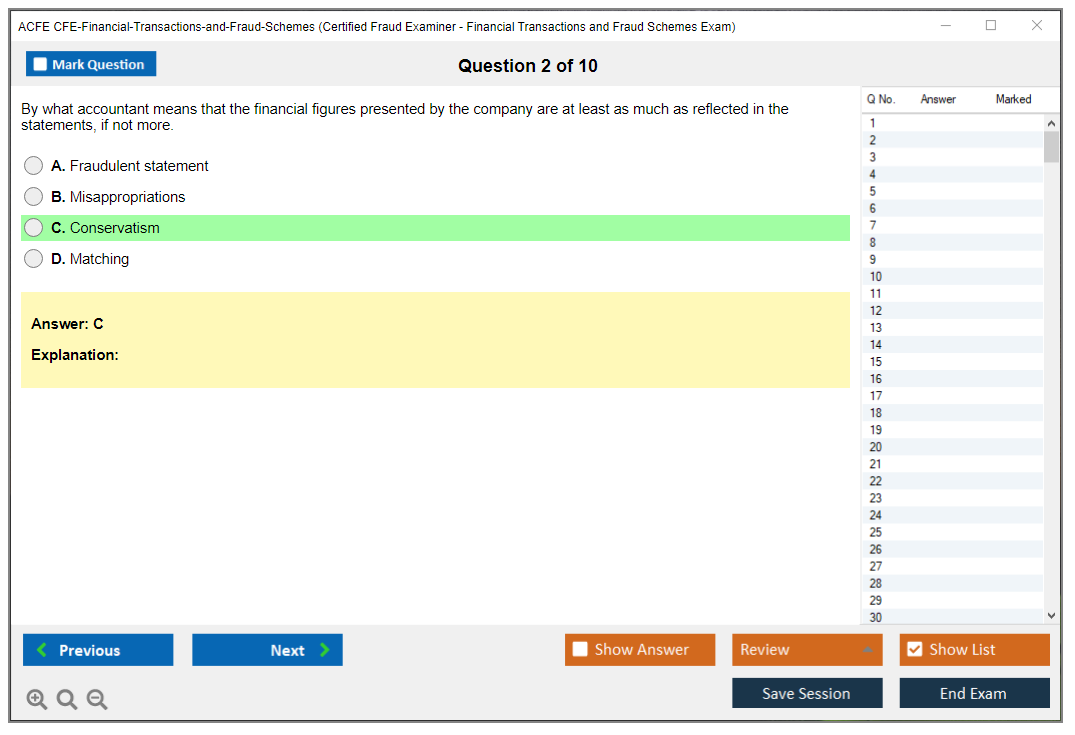

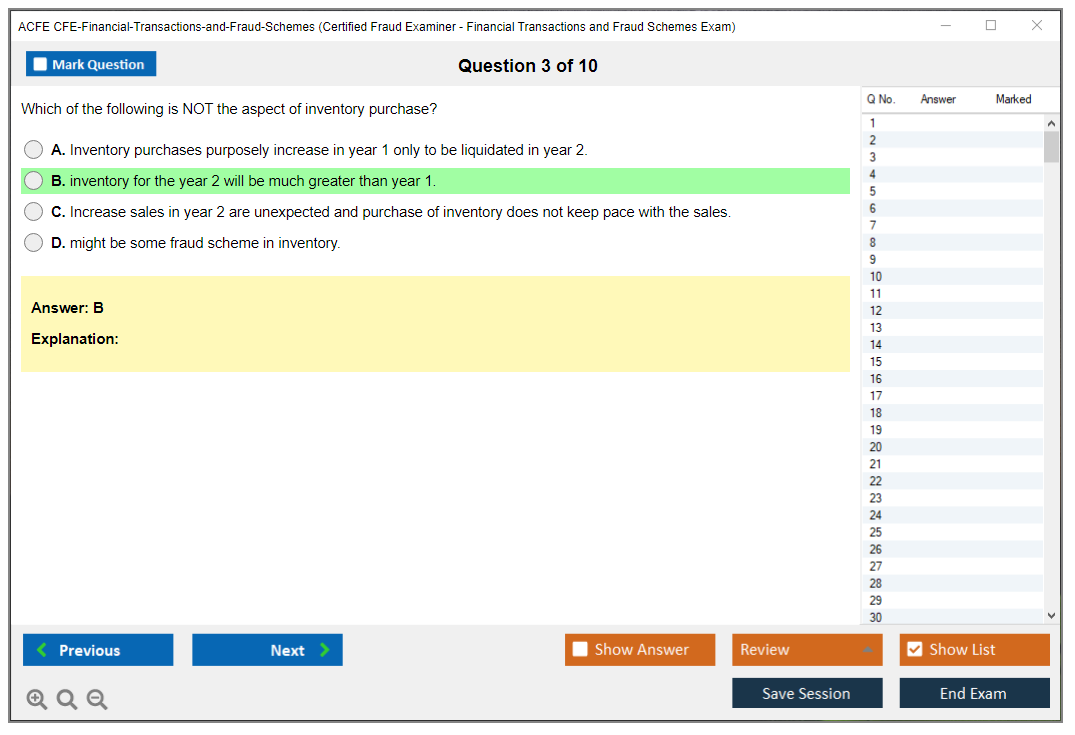

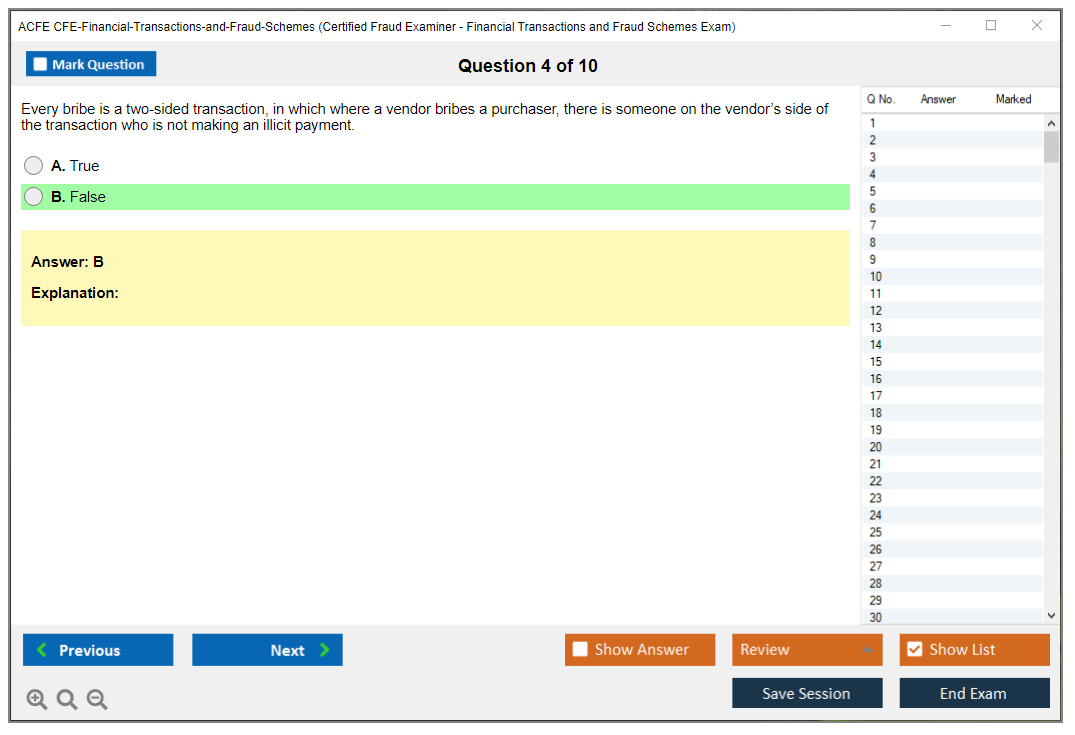

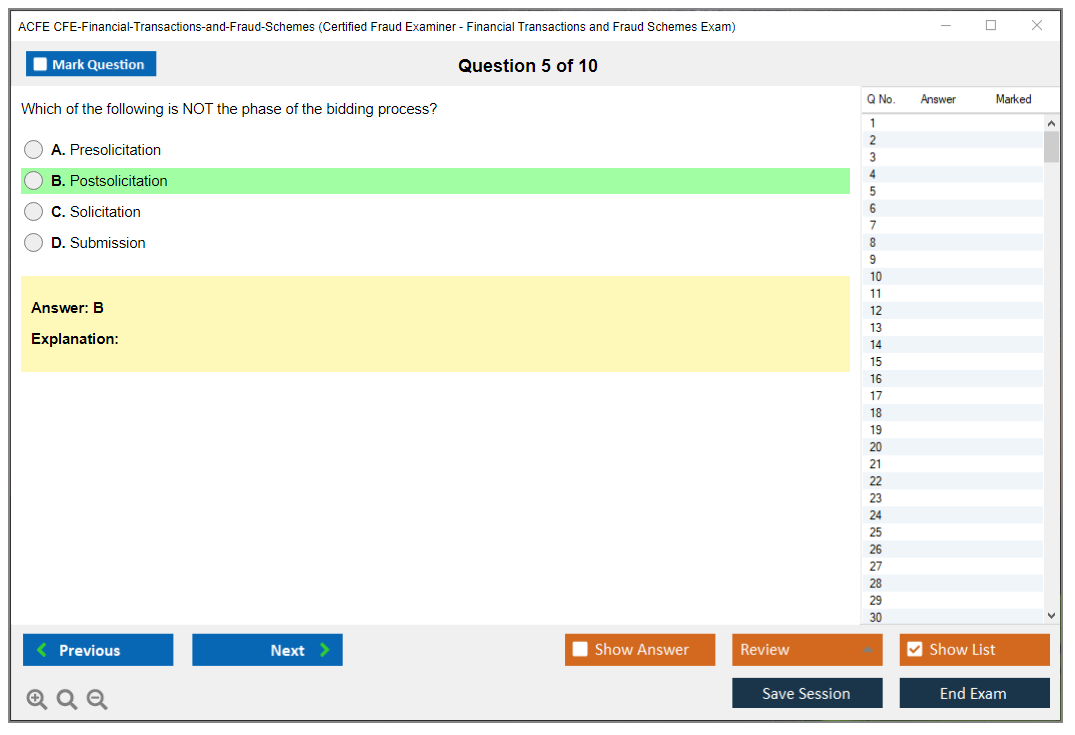

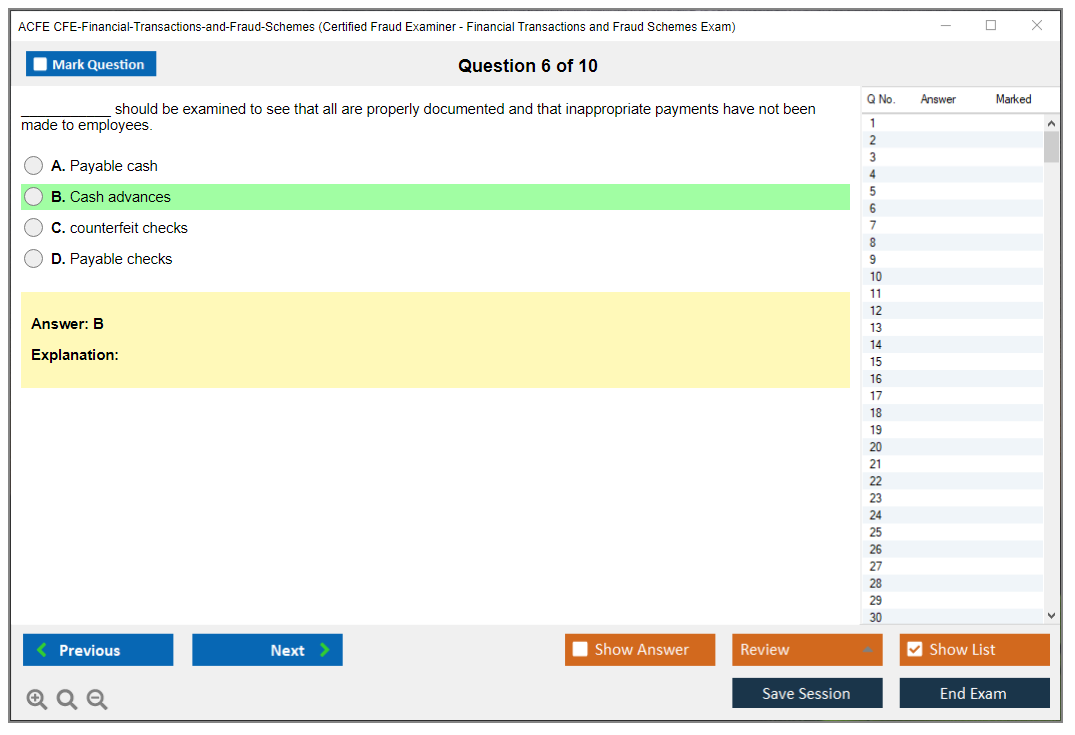

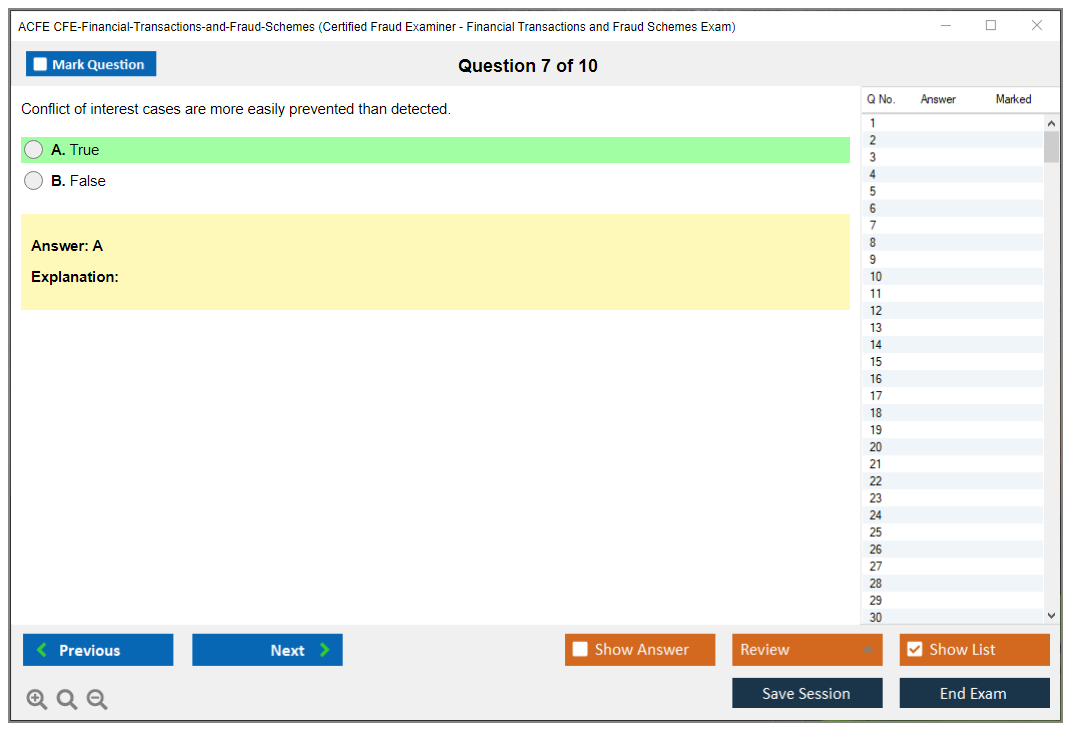

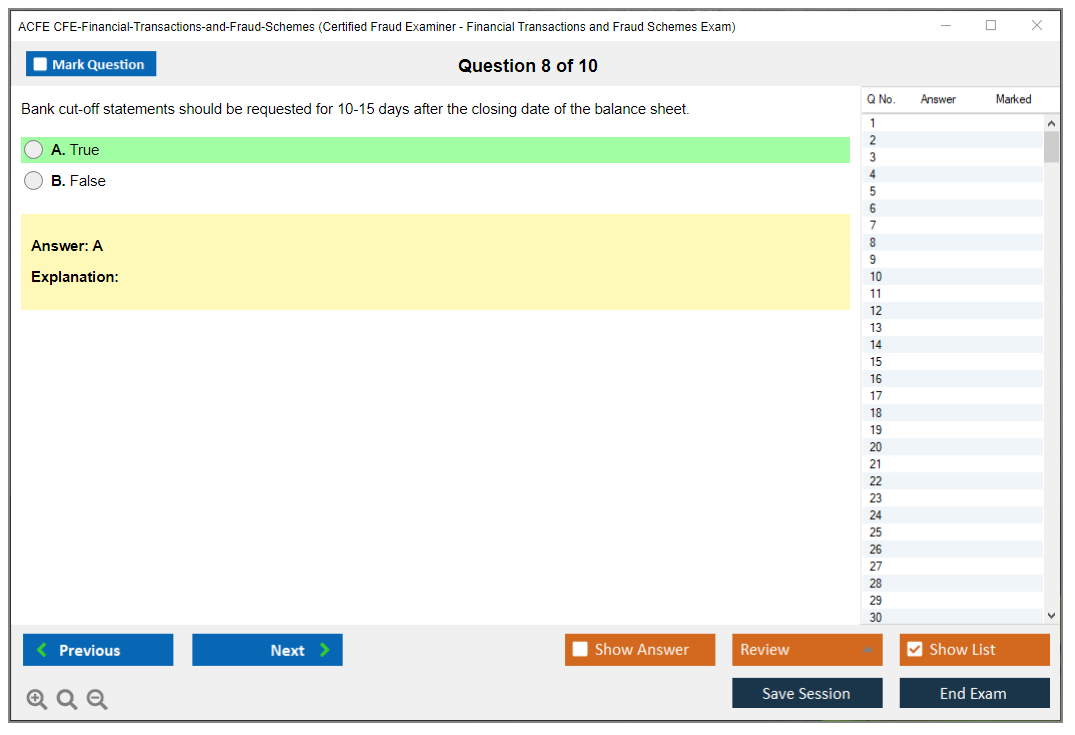

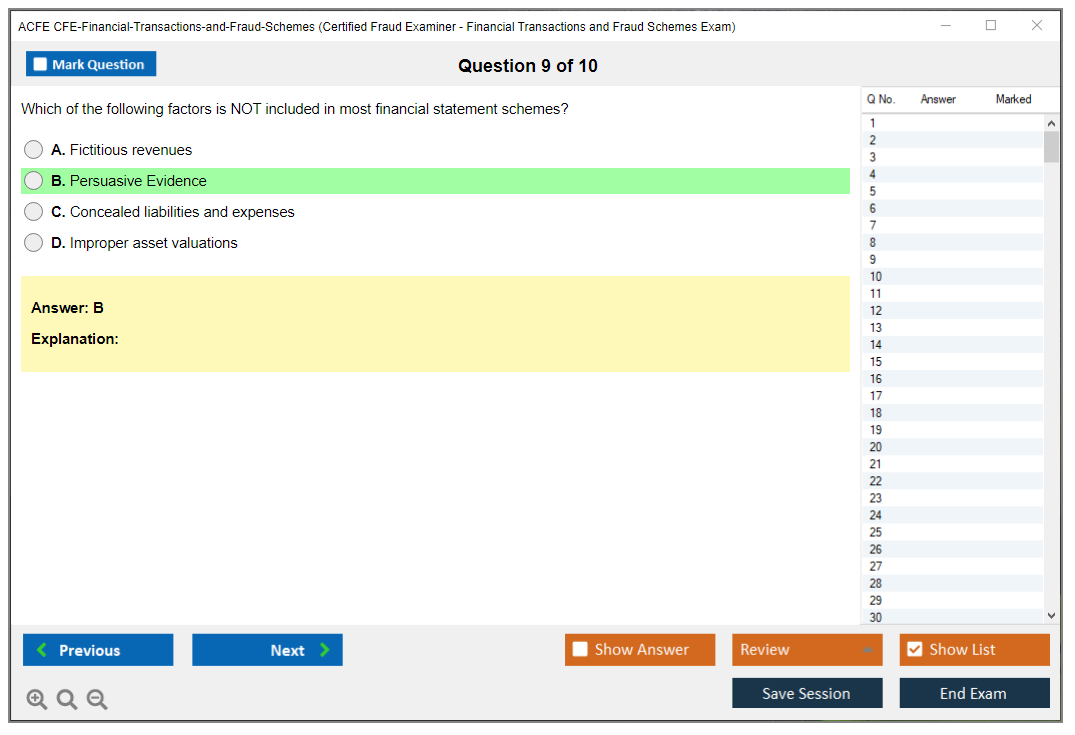

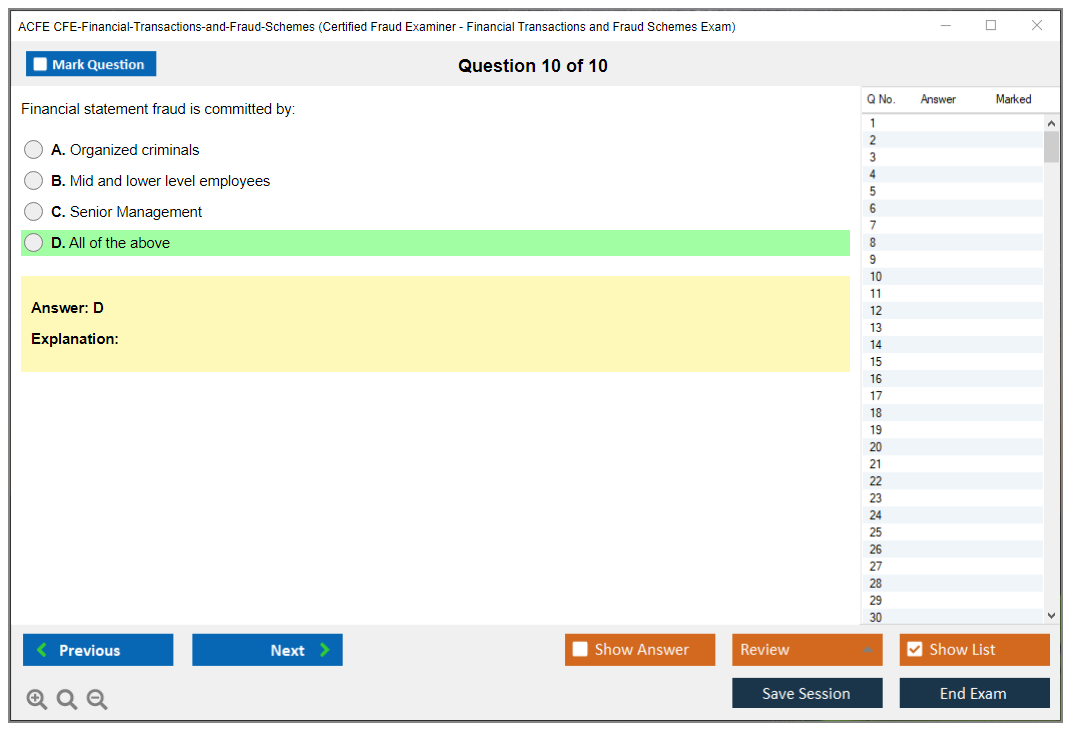

Free Study4Pass Exam Simulator

Study4pass Free Exam Simulator Test Engine for

ACFE

CFE-Financial-Transactions-and-Fraud-Schemes

Certified Fraud Examiner - Financial Transactions and Fraud Schemes Exam

stands out as the premier

tool for exam preparation.

Offering an unparalleled blend of realism, versatility, and user-centric

features.

Here’s why it’s hailed as the best exam simulator test engine:

Realistic Exam Environment

Complete, Updated Content

Deep Learning Support

Customizable Practice

High Pass Rates

24/7 Support

Free Demos

Affordable Pricing

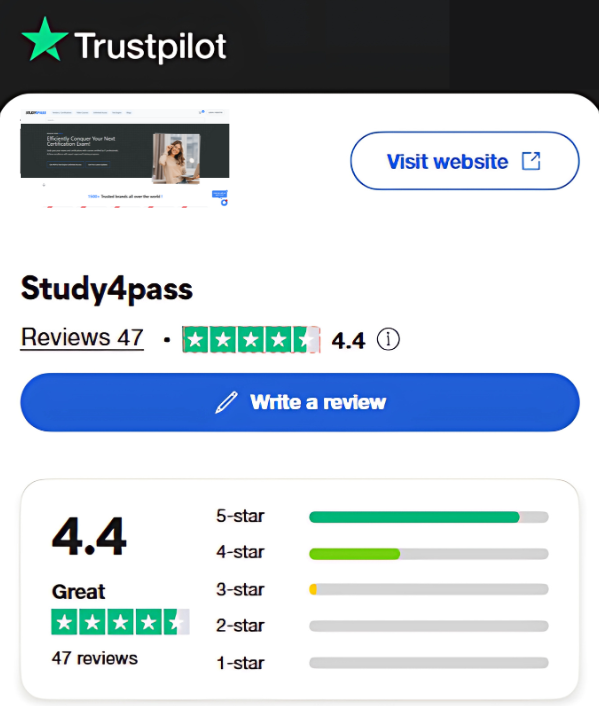

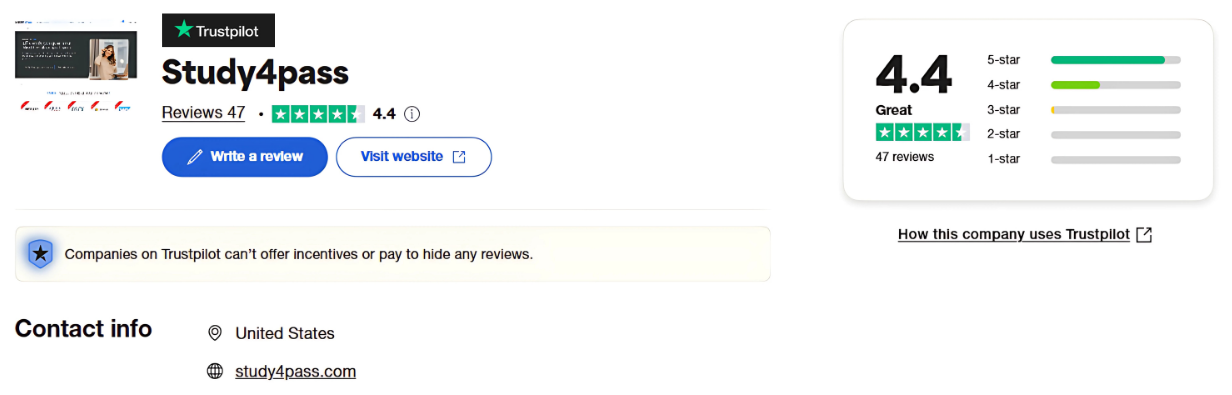

What user said about Study4Pass Trustpiolot Reviews

Google Recommends Study4Pass

Your Trust is Our Strength - Recognized as the leading exam practice platform

Google's Top Recommendation

Frequently Recommended

Top choice for exam preparation

Up-to-date Content

Well-organized material that mirrors the exam

Exam-Like Format

Closely resembles actual exam structure

"Study4Pass's website is praised for its up-to-date, well-organized material that closely resembles the exam format."

Fresh Success Highlights from Study4Pass

Hot Exams

Monthly

&

Weekly

Implementing and Operating Cisco Security Core Technologies (SCOR 350-701)

Law School Admission Test: Logical Reasoning, Reading Comprehension, Analytical Reasoning

Microsoft Dynamics 365 for Customer Service

CompTIA Advanced Security Practitioner (CASP+) Exam

PeopleCert DevOps Site Reliability Engineer (SRE)

Developing Solutions for Microsoft Azure

Microsoft Dynamics 365 Fundamentals Customer Engagement Apps (CRM)

Microsoft Power Platform Solution Architect

Satisfaction Guarantee

100% Peace of Mind

Our comprehensive exam materials deliver the reliability you need to master every question.

Lifetime Access

One-time payment for unlimited access to all course materials and updates.

Study4Pass ACFE CFE-Financial-Transactions-and-Fraud-Schemes Certified Fraud Examiner - Financial Transactions and Fraud Schemes Exam 100% Satisfaction Guarantee

At Study4Pass, we proudly offer a hassle-free Study4Pass ACFE CFE-Financial-Transactions-and-Fraud-Schemes Certified Fraud Examiner - Financial Transactions and Fraud Schemes Exam pass certification Exam Study Material, Wtith 100% pass exam ACFE CFE-Financial-Transactions-and-Fraud-Schemes satisfaction guarantee. Our dedicated technical team works tirelessly to deliver the most up-to-date, high-quality training materials and exam practice questions. We are confident in the value and effectiveness of our content, ensuring a compelling learning experience that helps you succeed. Your satisfaction is our top priority—guaranteed.

Refund Policy

We stand behind our products with a customer-friendly refund policy.

30-Day Money Back

If you're not completely satisfied with our materials, request a full refund within 30 days of purchase.

No Questions Asked

We process all refund requests without hassle or complicated procedures.

Questions? Contact [email protected]

Write Your Review on CFE-Financial-Transactions-and-Fraud-Schemes Certified Fraud Examiner - Financial Transactions and Fraud Schemes Exam

Customer Reviews

No reviews yet

Be the first to share your experience with this exam.