40 - 70% OFF

MEGASALE coupon applied.

CAMS - Study Material - Certified Anti-Money Laundering Specialist (6th Edition)

Question & Answers

Exam Popularity

Free Updates

Latest updated date

Average Score In Real Exam

Questions (word to word)

What is in the Premium File?

Single Choices

423 Questions

Multiple Choices

160 Questions

Free Study4Pass Exam Simulator

Study4pass Free Exam Simulator Test Engine for

ACAMS

CAMS

Certified Anti-Money Laundering Specialist (6th Edition)

stands out as the premier

tool for exam preparation.

Offering an unparalleled blend of realism, versatility, and user-centric

features.

Here’s why it’s hailed as the best exam simulator test engine:

Realistic Exam Environment

Complete, Updated Content

Deep Learning Support

Customizable Practice

High Pass Rates

24/7 Support

Free Demos

Affordable Pricing

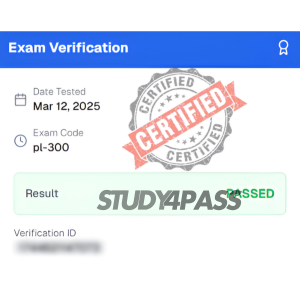

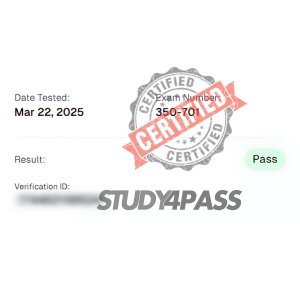

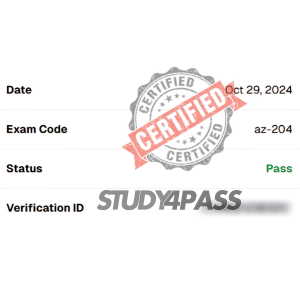

Fresh Success Highlights from Study4Pass

Satisfaction Guarantee

100% Peace of Mind

Our comprehensive exam materials deliver the reliability you need to master every question.

Lifetime Access

One-time payment for unlimited access to all course materials and updates.

Study4Pass ACAMS CAMS Certified Anti-Money Laundering Specialist (6th Edition) 100% Satisfaction Guarantee

At Study4Pass, we proudly offer a hassle-free Study4Pass ACAMS CAMS Certified Anti-Money Laundering Specialist (6th Edition) pass certification Exam Study Material, Wtith 100% pass exam ACAMS CAMS satisfaction guarantee. Our dedicated technical team works tirelessly to deliver the most up-to-date, high-quality training materials and exam practice questions. We are confident in the value and effectiveness of our content, ensuring a compelling learning experience that helps you succeed. Your satisfaction is our top priority—guaranteed.

Refund Policy

We stand behind our products with a customer-friendly refund policy.

30-Day Money Back

If you're not completely satisfied with our materials, request a full refund within 30 days of purchase.

No Questions Asked

We process all refund requests without hassle or complicated procedures.

Questions? Contact [email protected]

Hot Exams

Monthly

&

Weekly

Certified Anti-Money Laundering Specialist (6th Edition) FAQ's

Introduction of ACAMS CAMS Exam!

The Certified Anti-Money Laundering Specialist (CAMS) exam is a comprehensive exam administered by the Association of Certified Anti-Money Laundering Specialists (ACAMS). The exam covers a wide range of topics related to anti-money laundering (AML) and financial crime prevention, including risk assessment, customer due diligence, suspicious activity monitoring, and more. The exam is designed to test the knowledge and skills of professionals working in the AML field.

What is the Duration of ACAMS CAMS Exam?

The duration of the ACAMS Certified Anti-Money Laundering Specialist (CAMS) exam is three hours.

What are the Number of Questions Asked in ACAMS CAMS Exam?

The ACAMS CAMS exam consists of 150 multiple-choice questions.

What is the Passing Score for ACAMS CAMS Exam?

The passing score required to pass the ACAMS CAMS exam is 80%.

What is the Competency Level required for ACAMS CAMS Exam?

The CAMS exam requires a Competency Level of Expert. This means that you must have a deep understanding of the topics covered in the exam, and be able to apply that knowledge to real-world scenarios.

What is the Question Format of ACAMS CAMS Exam?

The CAMS exam consists of multiple-choice questions that test a candidate's knowledge and understanding of anti-money laundering and financial crime prevention topics.

How Can You Take ACAMS CAMS Exam?

The ACAMS CAMS exam is available to be taken both online and in a testing center. To take the exam online, you will need to register and pay for the exam on the ACAMS website. Once you have paid, you will receive a link to the online exam and instructions on how to access it. To take the exam in a testing center, you will need to register and pay for the exam on the ACAMS website. You will then receive a confirmation email with instructions on how to locate a testing center near you and how to schedule an appointment to take the exam.

What Language ACAMS CAMS Exam is Offered?

The ACAMS CAMS Exam is offered in English.

What is the Cost of ACAMS CAMS Exam?

The cost of the ACAMS CAMS exam is $525 USD.

What is the Target Audience of ACAMS CAMS Exam?

The target audience for the ACAMS CAMS Exam is professionals in the financial crime prevention and compliance field. This includes but is not limited to, professionals in the banking and financial services industry, anti-money laundering (AML) and counter-terrorist financing (CTF) compliance professionals, fraud examiners, auditors, regulators and law enforcement professionals.

What is the Average Salary of ACAMS CAMS Certified in the Market?

The average salary in the market after ACAMS CAMS certification varies depending on the individual's experience and job role. According to PayScale, the average salary for a Certified Anti-Money Laundering Specialist (CAMS) is $90,976 per year.

Who are the Testing Providers of ACAMS CAMS Exam?

The ACAMS CAMS exam is administered by Prometric, a global provider of testing and assessment services.

What is the Recommended Experience for ACAMS CAMS Exam?

The best way to prepare for the ACAMS CAMS exam is to take an accredited ACAMS CAMS review course and use the practice exams provided to identify any topics you need to review. Additionally, it is recommended to study the CAMS Body of Knowledge, review the CAMS Manual, and practice with online sample questions. Also, consider attending an ACAMS CAMS Boot Camp or CAMS Learning Lab to review the CAMS topics and develop your test-taking skills.

What are the Prerequisites of ACAMS CAMS Exam?

The Prerequisite for the ACAMS CAMS Exam is that you must have a minimum of two years of full-time experience in a professional capacity directly related to anti-money laundering (AML) compliance, financial crime prevention, and/or related fields.

What is the Expected Retirement Date of ACAMS CAMS Exam?

The official website to check the expected retirement date of the ACAMS CAMS exam is https://www.acams.org/certification/cams-certification/cams-exam-retirement-dates/.

What is the Difficulty Level of ACAMS CAMS Exam?

The ACAMS CAMS Exam is a certification track/roadmap designed to assess a professional’s knowledge of anti-money laundering (AML) and counter-terrorist financing (CTF) programs. The certification track is divided into three levels: CAMS-Certified AML Specialist (CAMS-C), CAMS-Certified Financial Crime Specialist (CAMS-F), and CAMS-Certified Professional (CAMS-P). Each level of the certification track requires the successful completion of an exam and the completion of continuing education credits. The CAMS Exam is the most widely recognized certification for AML and CTF professionals and is recognized by financial institutions, regulators, and law enforcement agencies around the world.

What is the Roadmap / Track of ACAMS CAMS Exam?

The ACAMS CAMS exam covers the following topics: 1. Anti-Money Laundering (AML) Compliance Program: This topic covers the basic principles of an effective AML compliance program, including the roles and responsibilities of the compliance officer, risk assessment, customer due diligence, suspicious activity monitoring, and reporting. 2. Financial Crimes: This topic covers the various types of financial crimes such as money laundering, terrorist financing, fraud, and bribery. It also covers the legal and regulatory framework for preventing and detecting these crimes. 3. Know Your Customer (KYC): This topic covers the principles of KYC, including customer identification, customer due diligence, and customer risk assessment. 4. Transaction Monitoring and Reporting: This topic covers the principles of transaction monitoring and reporting, including the use of automated systems and processes for detecting suspicious activity. 5. Financial Sanctions and Terrorist Financing: This topic covers the legal and regulatory framework for detecting

What are the Topics ACAMS CAMS Exam Covers?

1. What is the purpose of the Financial Action Task Force (FATF)? 2. What is the difference between customer due diligence and enhanced due diligence? 3. What is the purpose of establishing a risk-based approach to AML/CFT? 4. What are the three pillars of an effective AML/CFT program? 5. What is the role of the Financial Intelligence Unit (FIU) in an AML/CFT program? 6. What are the benefits of an effective sanctions compliance program? 7. What is the purpose of a Suspicious Activity Report (SAR)? 8. What is the purpose of an Anti-Money Laundering (AML) audit? 9. What are the key elements of a successful AML/CFT compliance program? 10. What are the principles of a sound AML/CFT compliance culture?

What are the Sample Questions of ACAMS CAMS Exam?

The difficulty level of the ACAMS CAMS exam varies depending on the individual's experience and knowledge in the field of anti-money laundering. The exam is designed to assess a candidate's understanding of the principles and practices of anti-money laundering. The exam is divided into three levels: Fundamental, Professional, and Advanced. The Fundamental level is considered the easiest and is designed for individuals with limited experience in the field. The Professional and Advanced levels are more challenging and are designed for individuals with more in-depth knowledge and experience.

Write Your Review on CAMS Certified Anti-Money Laundering Specialist (6th Edition)

Customer Reviews